This article covers how to raise the rent in Massachusetts, not just from a legal point of view, but most importantly from a business point of view. We review the four types of rent increases (none, modest, phased in, and large) and the conditions under which you may or may not be successful with any of these. At the end, we link to our rent raise form.

Ebenezer Scrooge might appear a kind and generous soul compared to how some tenants portray their landlords! Of all the professions in the world, which ranks lower in public perception than that of landlord? Images persist to this day of landlords as greedy, selfish tyrants who run their properties to the ground ignoring all tenant complaints while forcing rent collection. Because such landlords exist, however much we try to educate, landlords all too often get lumped into one unscrupulous category -- guilty without a trial!

Of course, when a good landlord stops by at 3 am because a tenant lost her key, or installs a new lock early Sunday morning, or races over at midnight to shut off a leaky water valve, these same detractors give no credit. They feel entitled to expect no less given what landlords seem to earn.

Most landlords operate fairly and counter to this stereotype. But we should all recognize a basic fact about our power as landlords. Not only when we set the rents, but also when we consider raising them, landlords significantly control the cost of housing. Whether or not individuals and families become homeless, or our buildings get foreclosed, is truly at stake. Emotions will run high on both sides.

And all this is to say nothing of the political context in which we operate, where landlords are at growing risk of having rent control or just cause eviction imposed. Unfortunately most landlord-tenant law has originated from highlighting the bad actors over the objections and best practices of the rest of the landlord community.

Perhaps you’ve avoided raising the rent for years. Myriad reasons might now exist for a rent increase. You might need more money to pay the bills. You might want more income to borrow for another building. You might be a trustee and have to keep up with the market for the sake of another. You might have improved your unit and feel a rent increase is justified. You might have a vacancy to fill and need to set a new rent. Your tenant might want to add a new roommate or a menagerie of cats and will pay more if you allow it.

Whatever your situation is, you will maximize success if, before you raise the rent, you assess whether or not it’s best to do so; and if so, by how much and when. It is critical to understand the role of the market, your management and maintenance style, your current tenant’s reaction, and/or your future tenant’s expectations for service. What you do as a landlord matters. Doing an assessment before you decide to raise the rent will enhance your success as a landlord.

Understand that what follows is not an argument against pursuing fair rent increases. It is critical, however, that you consider which approach is best.

Although the market plays a major role as mediator, approaches vary greatly between businesses. This is not news if you’ve talked to other landlords. Whereas many landlords go for years, if not decades, without raising the rent, others push their rents to the maximum as fast they are able, each year, like clockwork. There is a wide divergence in how this is handled.

The “Super Bowl story” below illustrates how the personal dimension can make rent increases very difficult.

One Cambridge landlord shared their experience: “I was all ready to tell my tenant there would be a rent increase. I had made peace with the idea. I had practiced my speech. And then she called and invited me down to watch the Super Bowl. I was paralyzed!”

The human complexities of being a landlord can be a surprise even for the most seasoned among us. Whereas landlords like the one above may wish to avoid conflict, others are willing (though not necessarily ready) to face conflicts head-on in pursuit of a rent increase.

Consider how pursuing a rent increase affected this other landlord, also speaking off the record:

“I assumed my tenant would graciously accept my request for a sizable rent increase. After all, I hadn’t raised her rent since she moved in four years ago. She knew I had been unable to make improvements given the low rent charged. Suddenly, though, I got a hefty list, and her words meant business! Not only had she included every deferred repair item and capital improvement imaginable, but she was demanding her security deposit back, new rules on access, a lead paint inspection, possible rent abatements, and then some! The headaches I never expected just for requesting a rent increase!”

Massachusetts law does not limit how high a rent increase can be requested. Assessing your own situation before doing so, however, will improve your game plan.

Older buildings earn lower rents. And when landlords make capital improvements, large one-time rent increases may be justified. For instance, tenants will often agree to pay large one-time increases when major kitchen or bathroom improvements are made. Note however that those who have been successful with this approach have always maintained and managed their old buildings carefully, and rents were always kept below market.

When buildings have not been properly maintained or managed, however, large one-time rent increases may sometimes backfire even after capital improvements have been made and rents are below market. Although some tenants will accommodate these rent increases, others may instead pursue their rights, particularly against legally vulnerable landlords (to be discussed below). This may result in unstable tenancies, legal trouble, and serious financial losses. Losses following rent increases are real and our staff have seen it hundreds of times! The reason is because of the tenant perspective.

Some tenants have told us they don’t see below-market rents as generous even when landlords offer high levels of maintenance and management. Such renters see it as a fair exchange given their perception that they have less power than landlords. Large one-time rent increases, even after capital improvements are made and rents are below-market, are seen by these renters as an unfair income transfer.

For other households, it’s not a question of paying more for a nicer apartment. For many, they are already stretched thin financially, and would prefer an older apartment that fits within their budget. That’s why they rented from you in the first place.

For others still, life events like death, divorce, and illness can create temporary but crippling financial setbacks that would make rent increases inconceivable given everything else going on. Privacy, shame, or other factors may cause you never to realize what a household is experiencing.

This is not to argue that your business should be held back to accommodate a certain political worldview, a low-income household, or a hard luck case. But it is to say that your customer’s perceptions and financial situation are real. Although landlords can borrow for and pay off their capital investments over time, tenants cannot borrow for rental housing and cannot easily get a better job or more hours to earn more in the future.

Your renters may be unable to absorb sudden, large increases now or in the future. Suggesting they should have saved money while the rent was obviously below market doesn’t help. (Never mind what may be prudent or reasonable for renters in a below-market unit to do, few American households have adequate savings. Displacement is a real issue with real societal costs.)

To put it bluntly, most tenants’ backs are up unless their habitability, property management and affordability needs are met.

Whether you view this tenant position as:

it is in your self-interest in these situations to behave moderately when raising the rent -- unless in very specific circumstances as described in the model below.

Landlords should consider the following factors regarding which approach to raising the rent will work best for the situation at hand.

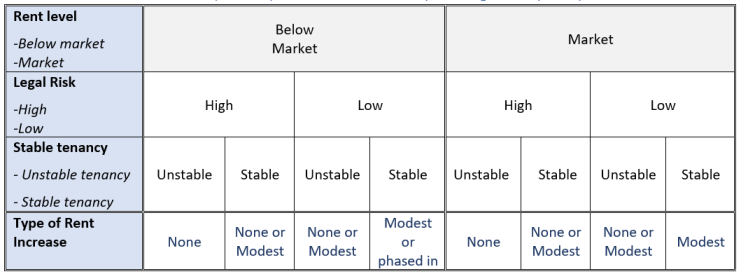

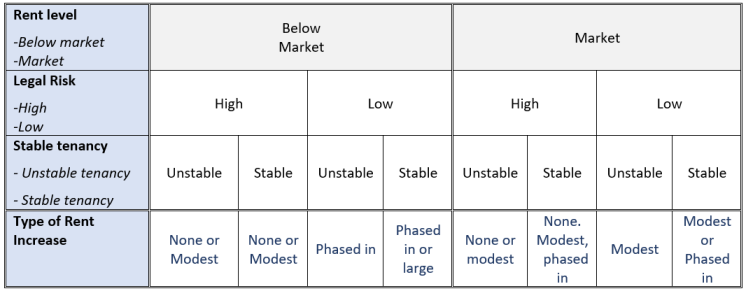

As the decision matrices show, your ability to command a rent increase should not be decided based solely on market conditions. Each property operates in a market niche. The condition of the building, your legal compliance, and your renter’s economic wherewithal determine your ability to raise the rent. If your business and your renter are not currently prepared for a rent increase, then you should not raise the rent on that unit at this time.

Rent increases described in the decision matrix take one of four sizes: none, modest, phased in, or large.

A “none” rent increase does not mean that rents may never be higher for that unit. But it does mean that until your unit turns over naturally, it is better not to change the rent amount. Note that “none” means “none,” not even an adjustment for inflation. Although your costs may be increasing in real dollar values, your renter may be in an industry or with a wage structure that is not keeping pace with inflation. To be sure, this will become a serious issue for your renter and for you over time. But you will have to deal with long-term sustainability outside of the context of a rent increase. Do not pick a fight under “none” conditions.

A “modest” rent increase means inflation. This could be determined based on a national metric, like the consumer price index, or local metrics, like your insurance and tax increases. “Modest” rent increases are supposed to be sustained by matching increases in renter household income. If your household is unstable, even a “modest” increase may be inadvisable.

A “phased in” rent increase is a large rent increase (faster than inflation) tied to specific milestones or timelines. For instance, you might require an additional 1% payment each month to get to a 12% increase. Or you might sign a two-year lease where every six months the rent increases. Phased in increases are recommended rarely. If your housing quality is low, a phased in increase is possible only if your premises are obviously below market and there are no other legal or stability issues. All phased in increases require that the household be stable and economically able to absorb an increase given enough time. Phased in increases may require a conversation about what time frame is reasonable.

A “large” rent increase faster than inflation with no phase in time is advisable only in high quality housing that is obviously below market, where you run your business like a tight ship, and where your renters are known to be stable and able to willingly absorb the increase. You may have heard of other owners using large rent increases to clear out units with undesirable renter behaviors or lease non-compliance. Caution: this strategy comes with legal costs. In a situation where a renter is failing to honor rental agreement terms, it is usually because they are not stable enough to find different housing that would offer the rental conditions they’re seeking. They will push back with force. Be careful with large rent increases.

The best time to increase the rent is when a unit turns over. Then there are no current renters to consider. Does this mean any increase can be justified? No. Even if repairs or major renovations are completed during the vacancy, you must assess your business’ ongoing legal compliance and the likely stability of your next renter household. Starting a new tenancy at an unsustainably high rent can result in the same kind of losses you would experience if you had raised the rent on an existing set of renters. Operating at top market requires expertise.

Assessing how tenants may respond to a rent increase will help you decide whether, when and how much to increase their rent.

Consider a scenario where the landlord installs a new bathroom floor to replace an old one that was spongy from splashed bath water. The landlord demands a large one-time rent increase to justify the expense, which they viewed as deriving from the renter’s failure to keep the floor dry. The rent is already at market and the renter household is already maxed out financially. Whether or not they admit to themselves that they caused the damage, the renters are now looking at either relocating or eventually running out of money. They may decide their best course of action is to react by giving the landlord an overblown repair list for the rest of the unit. Now both sides are in conflict, possibly with code enforcement, rent withholding, and more. In this situation, no rent increase was advisable.

We are not arguing against rent increases. We are suggesting, however, that, in many cases, phased in or modest increases will be seen as more reasonable and may also incentivize greater tenant cooperation than a large one time rent increase -- even after improvements have been made, and maintenance and management have been adequate. Financial losses can result from unwise rent increases, and our staff have seen it hundreds of times over the years.

Two more scenarios are worth considering.

Consider a landlord that takes a security deposit for an old unit that’s below market. Although the spirit of the law is complied with (the deposit is held properly under a landlord-tenant account) the landlord doesn’t know they had to issue a receipt and pay annual interest. They have never done so. This is a high legal risk, since the outstanding violations may call for triple damages on the amount of the deposit plus attorney’s fees. Even without knowing they have failed to comply, such a landlord might realize they have legal risk somewhere because they generally don’t do any paperwork for their business. This landlord may be at further risk from not documenting other sensitive situations such as their effort to secure tenant permission to access their units. In this scenarios, it is not advisable to increase the rent to market at the next renewal. It can all be clawed back with a dispute over the security deposit, proper access, habitability or much more. It will be critical to pursue no rent increase or only an inflation-based increase, even though the unit is below market. Large rent raises require full legal compliance.

Are we saying you can knowingly break the law and get away with modest rent increases? No, of course not. But there are many traps for the unwary in Massachusetts, and a rent increase above a certain size could be the trigger that springs the trap. We have seen it more times than we can count. Large rent increases are for experts only. If you want to climb to top-market rents in leaps and bounds, you need to have full compliance and know it.

Finally, consider a single elderly renter that has lived in the premises for over 20 years. The rent is far below market, the premises are still to code but badly dated, and the renter is stable at that low price point. A phased in rent increase to get back to market while making upgrades might be justified in our model. Or consider going off-model and moderating your rent increase. Many of our members with established businesses take pride in going above and beyond the landlord stereotype, making the world a better place, and helping someone get by just because.

We’re not suggesting you be a pushover, and there are risks associated with keeping rents too low, but many landlords do report feeling joy and satisfaction when they can provide quality, affordable housing to those who genuinely need it, appreciate it, and are stable long-term. No one can tell you which renter to give charity to, but one day you may decide to go out of your way for someone. When it happens, you will be in good company and doing right by yourself.

A note on discrimination: we are not aware of any case against any landlord who went out of their way to help a member of a protected class. You do not need to raise the rent on all elderly renters just because you worry you would be perceived as discriminating against other renters. Apart from the age issue, you also have wide leeway to make exceptions for long-term residents.

Learning which type of rent increase is best for which situation, if any, can help you get the rent increase you deserve while strengthening tenant relationships as well. Landlording will be more profitable, more satisfying, and easier to handle as a result.

If after reading all that, you are sure your business can sustain a rent increase for a given unit, then you need to follow a Massachusetts compliant process.

If a tenancy is stable, you can sign a rental agreement modification (one page) to mutually agree to modify the rent amount. Although commonly done, this is not legally watertight. You cannot in general get someone to concede something (like a higher price) when they are already contractually entitled to a better situation (e.g., lower price) unless you offer consideration (e.g., money, improvements, etc). This “modification” approach relies on a mutual understanding that the rent increase will not need to be enforced by a court.

If a tenancy is unstable, or for complete watertightness, you must use the “no more Mr. Nice Guy” approach and issue a termination notice in accordance with your rights under the existing rental agreement (although it helps to include a letter inviting tenants to talk first before any fight breaks out). Then you can offer to create a new tenancy at new terms, including higher rent. Termination notices are legal documents and may have legal repercussions. This is why rent raises in Massachusetts require you to first evaluate your legal risk.

Read more on the page about our Rent Raise Form.

It is critical to look at not just the market, but also at your business, your building, and your renters before deciding whether, how much, and when to raise the rent. Careful decision making will help your business succeed year after year with minimal losses. Don’t be a pushover, don’t take society’s burden onto your shoulders, but do decide carefully and proceed judiciously. Your business and all of ours may depend on it.

As part of our certification work, MassLandlords is developing these best practices for addressing how to deal with raising the rent. All MassLandlords members have valuable experiences and insights to share. We will update this article based on member feedback. Thoughts? Let us know at hello@masslandlords.net.

Still have questions?Helpline subscribers can ask for business advice and legal information.